Climate policy uncertainty and corporate environmental …

Kim et al. (2025)

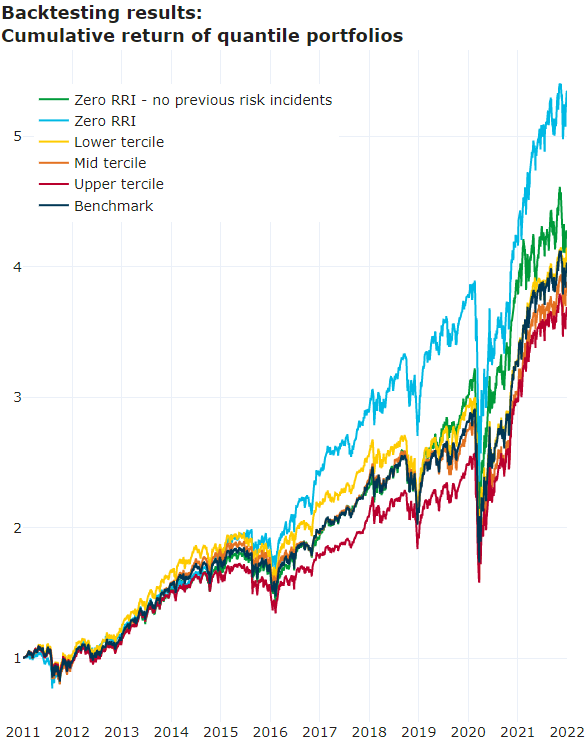

Below, RepRisk provides access to live code and data with our latest business conduct and reputational risk scores based on a sample set of companies. This decision, borne of RepRisk’s mission to drive positive change via the power of data and transparency, enables clients to customize their own risk metrics – helping them make informed decisions toward their goals of sustainability and alpha generation.

Our methodology is fully trusted, proven, and transparent.

To facilitate research at universities around the world, RepRisk Data is available through Wharton Research Data Services (WRDS), the Wharton School’s award-winning data analytics and research platform that serves over 75,000+ users in over 35+ countries.