# I. Introduction

Growth in private equity is phenomenal: in the past ten years assets have doubled in size, and it is estimated that by 2025 AUM will hit USD 5.8 trillion. The asset class has a lot of opportunity when it comes to ESG integration. When investors are polled, access to quality ESG data is cited as a major barrier to ESG integration. However, this barrier only exists for those who don’t know about RepRisk – the only ESG data provider with private company coverage since day one 18 years ago.

Because private market firms invest so much time and energy into their due diligence processes, it may feel like there is no risk that has been overlooked. However, by relying primarily on company self-reported data, private market firms might not be getting the full picture. Company disclosures can be unreliable, biased, or mask risks. This is where RepRisk can shine a light: on these hidden risks.

II. What do hidden risks look like?

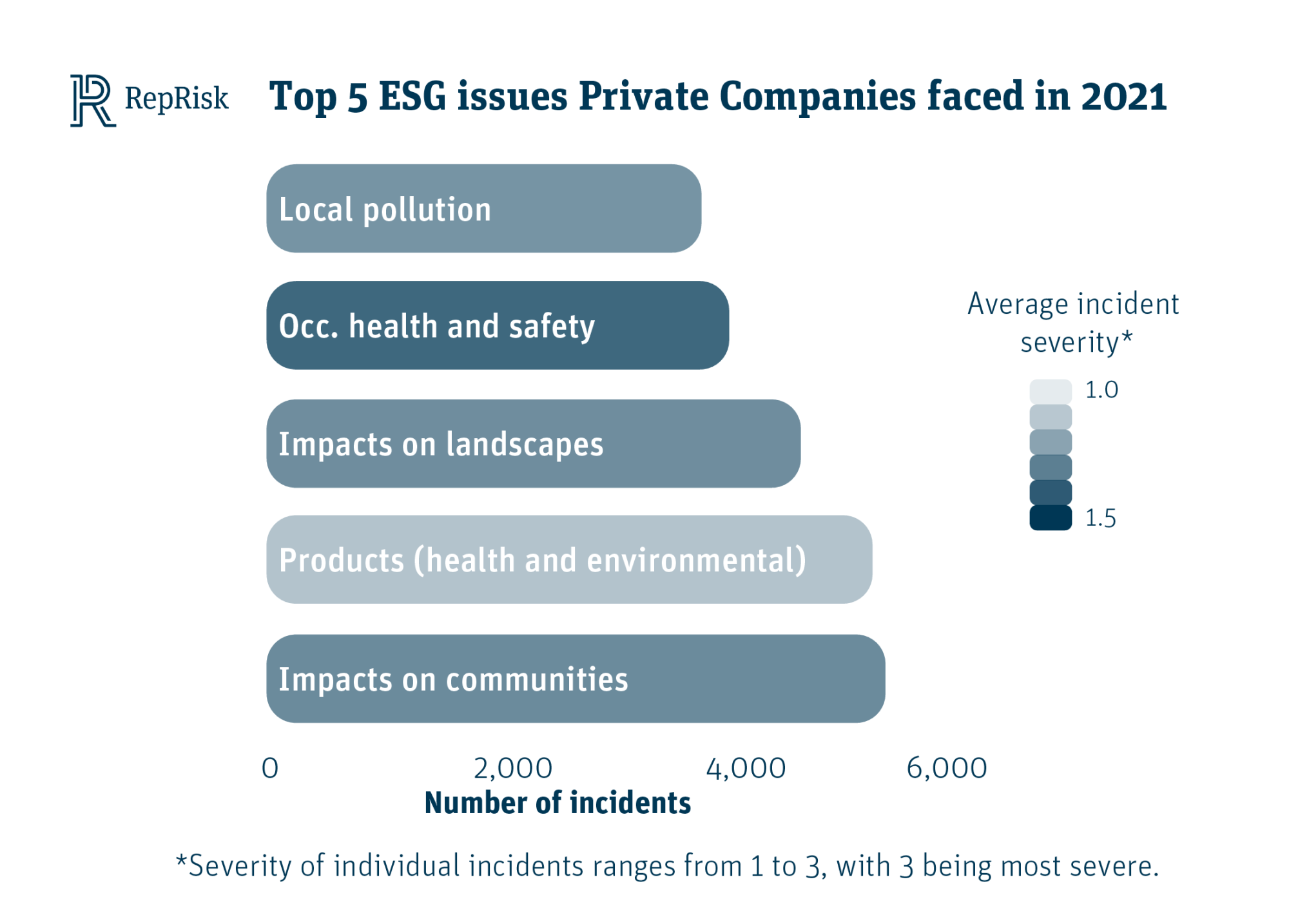

RepRisk covers more than 290,000+ private companies across developed, emerging, and frontier markets. To illustrate, let’s look back at the top five ESG issues private companies faced in 2021:

Source: RepRisk ESG data science and quantitative solutions, www.reprisk.com

The top ESG issue, ‘Impacts on communities’, most commonly entailed impacts to land ecosystems, health, and economic impacts on local communities.

The Mining, Utilities, and Support Services1 sectors had the most risk incidents related to ‘Impacts on communities’.

‘Products (health and environment)’ was the number two ESG issue.

The top three Products risk incidents were related to Negligence, Epidemics/Pandemics, and Health impacts.

The top three sectors with risk incidents related to Products were Food and Beverage, Retail, and Personal and Household Goods. Those risk incidents included food and toy recalls, and products with palm oil, carcinogenic elements, or harmful ingredients.

RepRisk curated this data by excluding company self-disclosures – looking instead at more than 100,000 media and stakeholder sources in 23 languages every day. That means that if any company in the world is exposed to an ESG risk, RepRisk will capture it. The world’s top private market firms rely on RepRisk data for pre-transaction due diligence, post-transaction risk monitoring, and company engagement/value creation. ESG will only become more embedded in private markets operations in 2022. RepRisk stands at the ready to comprehensively facilitate this work.

Learn more about how RepRisk serves our private equity clients: