# I. Painting the town green

Misinformation and minimization of ESG risks pose a threat not only to credibility, but also to our collective ability to transition to a sustainable future. While regulation is stepping in with good intentions, investors and consumers need to do significant research, reading the fine print and assessing actions, to determine the truth behind sustainability claims. Identifying meaningful data to support this process presents a challenge, with traditional ESG ratings often masking underlying risks and varying across providers.

How can an outside-in approach to ESG help investors spot greenwashing in their portfolios? In this article, we introduce RepRisk’s unique perspective on greenwashing risk, review trends based on historical data, and look at greenwashing through the lens of two facets of this issue: climate lobbying and climate compensation. We find that in recent years, climate change is increasingly the subject of greenwashing and ESG risk data indicates the rising accountability of climate action across sectors.

# II. The role of ESG data in spotting greenwashing

Greenwashing misleads consumers and stakeholders to view a company’s environmental footprint in a more positive light. At RepRisk, we capture greenwashing through the intersection of two ESG issues, flagging incidents when companies are involved in misleading communication on the environment. ESG risk incidents in this scope may include events such as criticism of an advertising campaign deceiving consumers on environmental impacts, research findings revealing that a company is overstating the impact of an initiative, or coverage of company actions in direct contrast to climate commitments.

We focus solely on risk by analyzing public sources and stakeholders for information that tells us what the world is saying about a company. This perspective circumvents greenwashing by capturing the impact of a company rather than its messaging– and helps investors assess a company to make better investment decisions and move the world toward sustainable capital allocation.

# III. Ten years of greenwashing data

With an ESG dataset dating back to 2007, RepRisk has a unique perspective on the evolution of issues as the ESG industry has grown. Reviewing the past ten years of data (2012-2022) linked to greenwashing, we observed an increase in the number of such incidents and a shift in the regions, topics, and sectors involved.

# IV. Greenwashing risk escalating for companies headquartered in Europe and the Americas

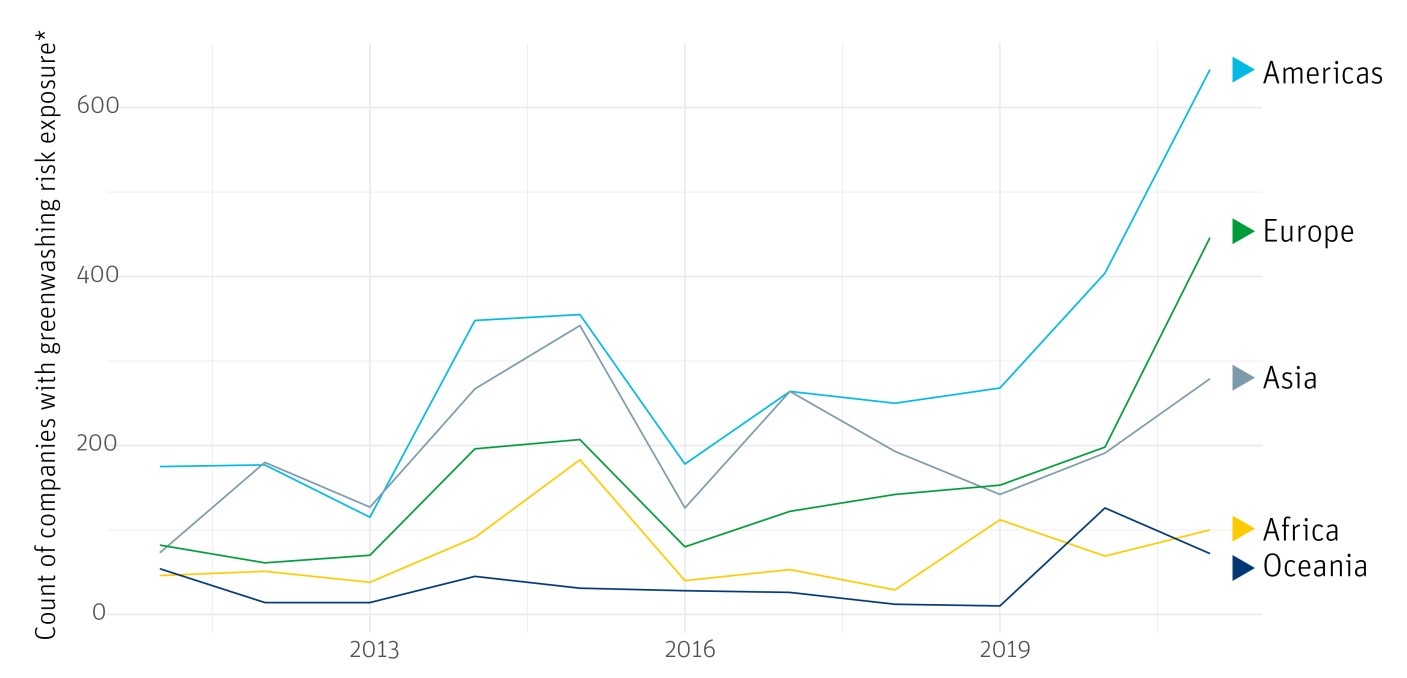

*Reflects the count of unique entities with at least one ESG incident linked to both environmental footprint and misleading communication in a given year.

Source: RepRisk ESG data science and quantitative solutions, www.reprisk.com

Greenwashing increased around the signing of the Paris Agreement in 2015, which brought public attention to the issue. In 2021, the practice was highly criticized in Europe and the Americas, with many such incidents coming from low reach sources. These incidents could include criticism from a lesser-known NGO or coverage of legal proceedings by a local newspaper. Amidst this changing frequency of greenwashing, the share of environmental topics that are linked have remained relatively stable, with one exception.

# V. Climate: the growing subject of greenwashing

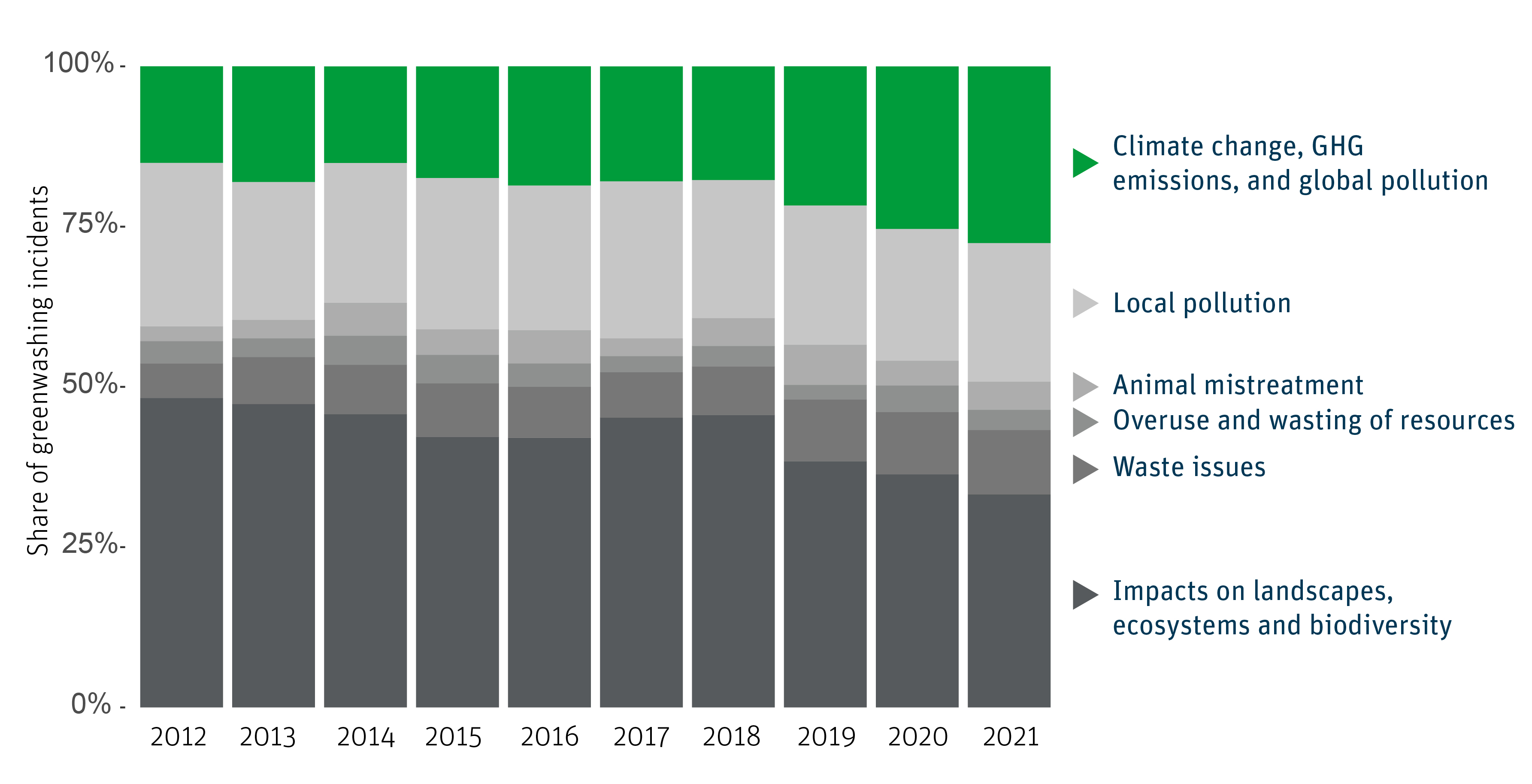

Source: RepRisk ESG data science and quantitative solutions, www.reprisk.com

In recent years, the issue of climate change, GHG emissions, and global pollution has become a more prominent subject of greenwashing. In the past two years, approximately one of every five climate-related ESG incidents was also linked to misleading communication. This value increases to one out of every three incidents when we look only at the Food and Beverage sector.

"With the increase in regulatory initiatives specifically coming out of the European Union and North America (i.e.: the SFDR, the EU Taxonomy), companies are being held much more accountable to their carbon reduction targets and general climate policies and disclosures. This scrutiny is reflected in mainstream media, as the companies acting with impunity in the face of their climate commitments are now being called out publicly, which is reflected in our research.” says Tess Dury, ESG Research Lead at RepRisk.

“What we're starting to see more regularly, is companies being criticized earlier in the process, before greenwashing occurs. For example, not abiding by legal requirements for their disclosures, as with a bank improperly implementing a green credit policy.”

To better understand what is driving this increase in the prevalence of climate-related greenwashing over the past five years, we reviewed how the distribution of contributing sectors has changed.

# VI. Shifting breakdown of sectors linked to climate greenwashing

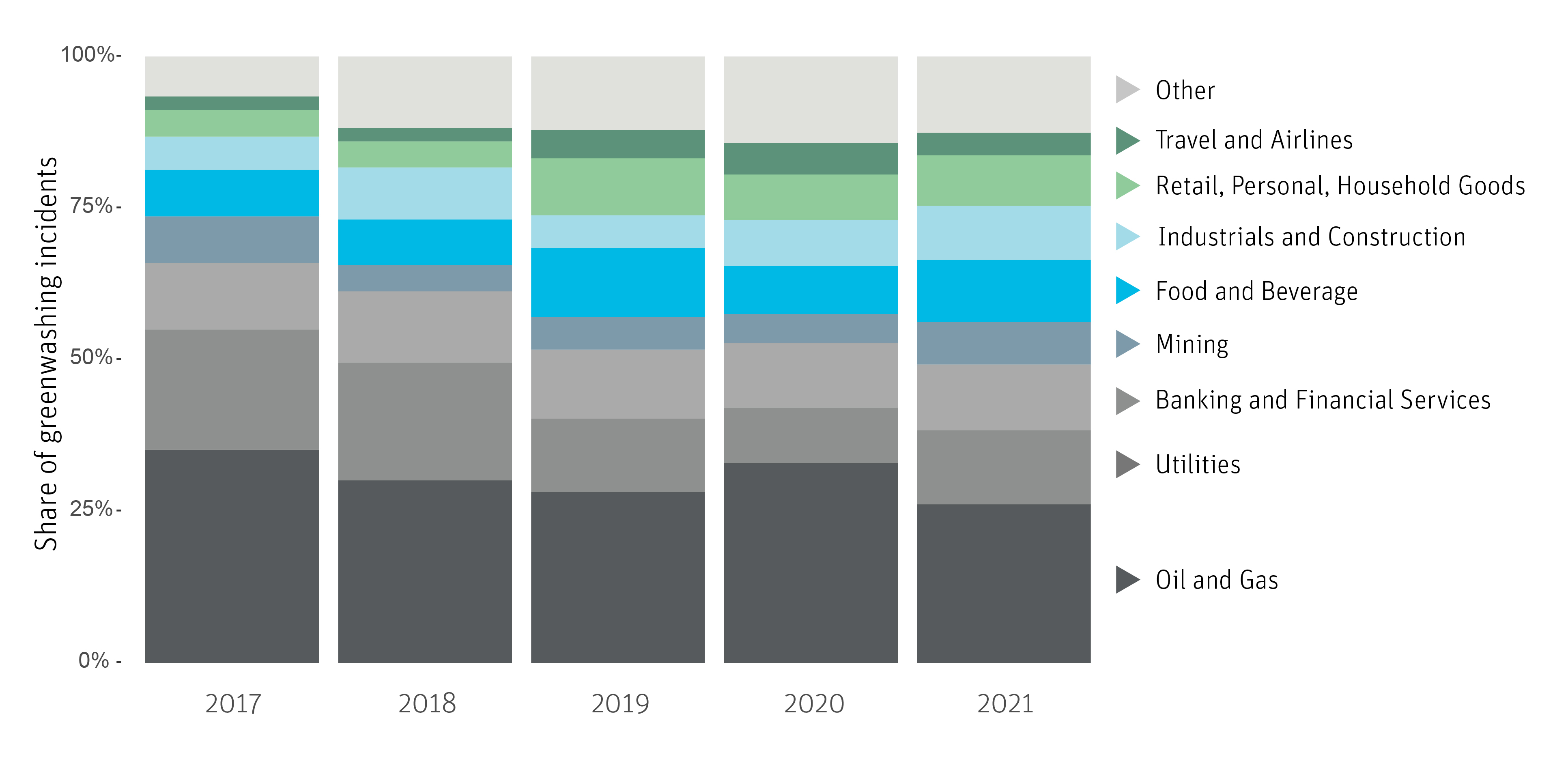

Based on count of ESG risk incidents linked to misleading communication surrounding climate change, GHG emissions, and global pollution

Source: RepRisk ESG data science and quantitative solutions, www.reprisk.com

Over time, the breakdown of sectors criticized for greenwashing has become increasingly fractured, showing the rising accountability of climate action across industries.

# VII. Climate lobbying and ESG risk exposure

RepRisk covers a range of greenwashing activities through our comprehensive list of 28 ESG Issues and 80 Topic Tags. Focusing on lobbying activities is a powerful way to evaluate whether companies ‘walk their talk’ when it comes to environmental issues. Lobbying frequently goes unnoticed to the public eye and is not disclosed in self reports. In relation to climate change, this could involve a company directly or indirectly influencing climate or emissions policy decisions to their advantage, while publicly marketing themselves as green. The Global Standard on Responsible Climate Lobbying has brought investor attention to this issue, calling on companies to align their actions and commitments with the Paris Agreement goals.

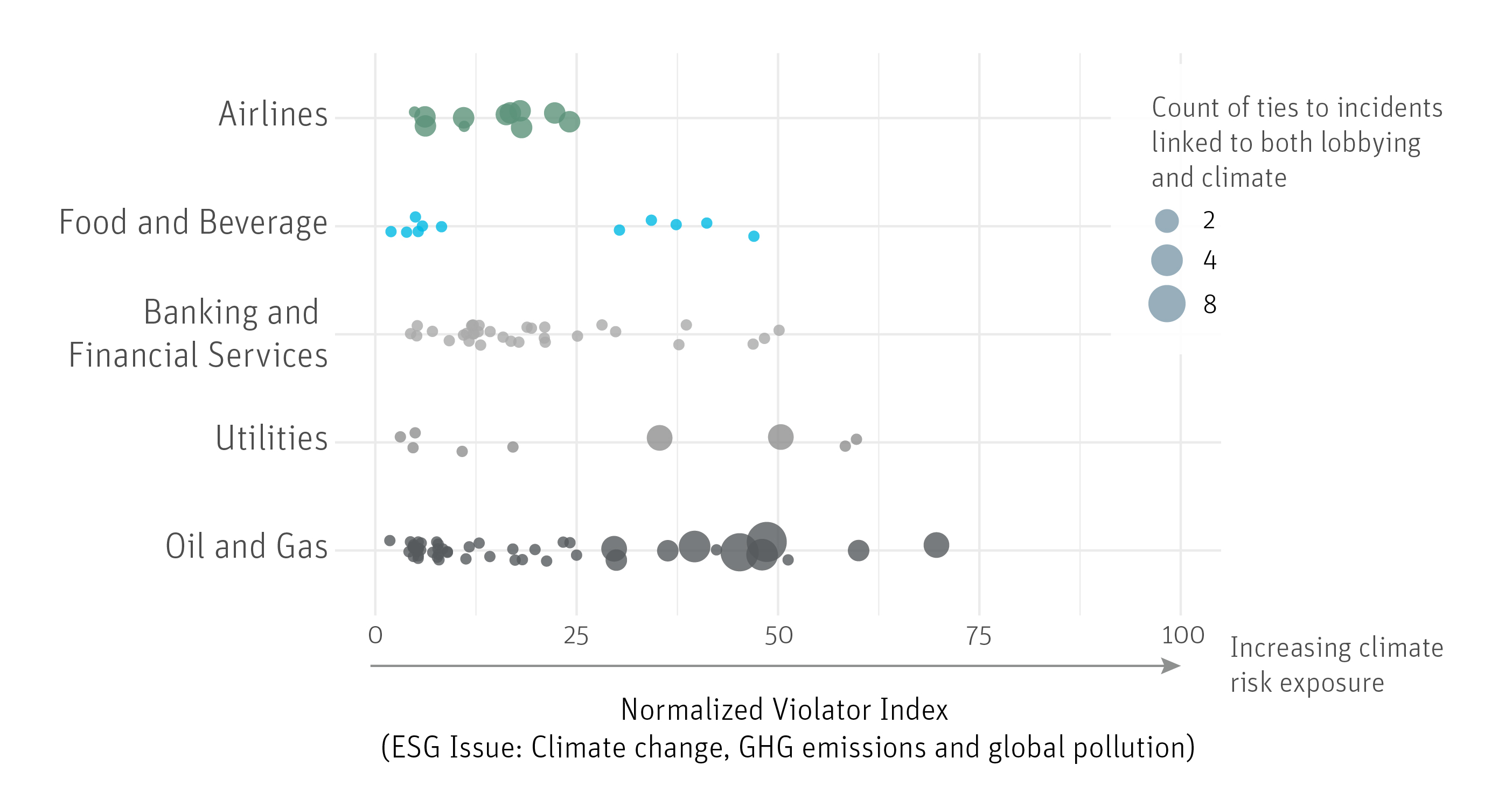

RepRisk supports tailored ESG analysis with the RepRisk Violator Index, a customizable metric that allows users to assess a company’s risk exposure related to one or multiple issues. With this metric, we specifically reviewed the climate risk exposure of companies engaging in and criticized for climate lobbying. The following graphic investigates whether companies with higher climate risk exposure engage in lobbying more frequently.

# VIII. Skin in the game: climate lobbying and ESG risk exposure

Climate change, GHG emissions, and global pollution Violator Index for 116 companies linked to at least one incident of climate lobbying in the past two years.

Source: RepRisk ESG data science and quantitative solutions, www.reprisk.com

We observe that Oil and Gas companies with higher climate risk tend to lobby more. However, repeat lobbyists in the airline sector tend to maintain lower overall climate risk exposure, with the carbon-intensive mode of transit viewed as a necessity dependent on technological advances. While companies in this sector publicly commit to ambitious change and innovation, in reality, progress is slow, and the burden of reducing air travel emissions is often placed on the individual. In the other sectors reviewed, few companies were linked to climate lobbying more than once in the past two years, but lobbying remains a critical issue. For instance, in the Banking and Financial Services sectors, lobbying efforts may aim to curb sustainable finance policies, while in Food and Beverage this may involve minimizing the perceived impacts of animal agriculture to block policies that would impact production.

# IX. Long-term problems, near-term solutions

Another common and complex theme in climate greenwashing is the use of offsets, which provide an economic means of compensating for one action (e.g., emissions) in one area by making up for it in another. While most commonly associated with carbon, companies can also offset their biodiversity and water impacts. Offsetting programs have been brought under scrutiny as a near-term solution in a market that has been exposed to a variety of ESG issues itself, notably including fraud. For instance, tree planting initiatives have been linked to the displacement of communities, introduction of non-native tree species, and logging of trees after only a few years.

Without proper research and regulation, offsetting often fails to accurately mitigate GHG emissions and disincentivizes companies from directly addressing the root cause of their carbon footprint. Despite these concerns, researchers agree negative emission technologies, which remove CO2 from the atmosphere, are critical in handling residual emissions to meet the Paris Agreement goals.

We reviewed a sample of incidents linked to both carbon offsetting programs (e.g., emissions offsets, carbon capture, and climate compensation) and misleading communication over the past five years. Below are a handful of sample incidents to shed light on how ESG risk related to climate compensation initiatives presents for different sectors:

- Banking and Financial Services: Financers of carbon offset project criticized for eviction of local communities to acquire land for forest plantation.

- Food and Beverage: Fast food company accused of using ineffective tree planting to compensate emissions.

- Oil and Gas: Fuels supplier accused of buying carbon credits to overstate impacts on the climate and avoid paying carbon taxes.

- Utilities: Transportation project accused of purchasing controversial offsets from a hydroelectric plant abroad linked to negative environmental and social impacts.

- Travel and Airlines: Advertising regulator criticizes airline for carbon-emissions free flight claims.

These incidents highlight the importance of adequate research, regulation, and evaluation of a range of ESG risks to companies applying negative emissions technologies at scale.

# X. Meeting the challenge ahead

The data shows how difficult it is to get ESG right – as we saw with carbon offsets, a lot of issues are intricate, and greenwashing is prevalent. Greenwashing is not always about outright lies, but levels of truth, shining a spotlight on one initiative to conceal another, and placing key information in the fine print.

Meaningful ESG work needs robust data and a clear understanding of the purpose it serves. RepRisk focuses on systematically identifying, assessing, monitoring, and quantifying ESG risks that can have reputational, compliance, and financial impacts. With our transparent methodology, you can see in detail how we built our data and metrics, and even customize your own with our set of Jupyter Notebooks. While avoiding greenwashing is a continual task, RepRisk has material, comprehensive, and timely data to tackle this challenge and support decision-making for investors.

Copyright 2022 RepRisk AG. All rights reserved. RepRisk AG owns all intellectual property rights to this report. This information herein is given in summary form and does not purport to be complete. Any reference to or distribution of this report must include a link to the content to provide sufficient context. The information provided in this presentation does not constitute an offer or quote for our services or a recommendation regarding any investment or other business decision. Should you wish to obtain a quote for our services, please contact us.