# RepRisk interviews Jeremy Zhou, Vice President, Head of Indexing Solutions at FactSet

1. RepRisk: Please introduce FactSet Index Solutions and tell us about the work that you and your team do.

Jeremy Zhou: FactSet was founded more than 40 years ago to provide superior content and analytics to investment professionals. Our Index Solutions team is in the business of delivering bespoke beta to clients, which means we partner with clients to understand the exposures they wish to capture and construct portfolios accordingly. These exposures are multifaceted and could range from themes, sectors, factors, ESG, or some combination. The biggest challenge is the process of discovery and experimentation, looking at all possibilities from a content and methodology perspective, and collaborating with our clients to translate their visions into realities. One might question the scalability and efficiency of this highly customized process, but that is where our FinTech advantage shines. We deploy proprietary technologies and data to fast-track development without sacrificing quality – it’s a vision toward robo-indexing.

2. RR: Please tell us why you chose RepRisk data and the value you see in having outside-in, riskfocused ESG data as part of ESG index construction?

JZ: We value innovation and unconventional thinking when it comes to data and RepRisk fits the bill. Historically, investors have relied primarily on data disclosed by companies to analyze their investment merits, and that could be both limiting and risky. We believe an outside-in approach is an antidote to some of the inherent biases contained in company self-disclosed data.

To give an example, what is the first thing you do when you receive an unsolicited LinkedIn invitation? For me, it’s not looking immediately at the person’s profile but instead our common contacts. Knowing the professionals this person is associated with provides important clues about them, and that is exactly an outside-in approach. Whether we are talking about an ESG index or active portfolio construction, having access to data that is less prone to bias, less conventional (i.e., a variant perspective), and timelier leads to improved securities selection.

3. RR: In your perspective, what are the main drivers for the current demand around customized ESG index or index tracking product?

JZ: Demographics and democracy; they intertwine and reinforce each other. The demographic driver is further broken down into two components. The first component is the increasing assets and influence of the Millennial generation and their desire to invest more responsibly; Gen Z, who are just entering the workforce, also share a similar if not even stronger desire. The second component is the Boomers who are entering retirement with much longer life expectancy, thereby forcing pension funds and wealth managers to think about investing in long-term, sustainable businesses.

The democracy driver stems from a secular trend toward more open societies around the world and the democratization of information. As the costs and barriers to information continue plummeting, people become more aware of what is happening and who might be good or bad corporate actors. This collective awareness puts pressure on governments and regulators to take actions and we see this manifested in the many ESG policies being erected in Europe.

4. RR: What do you perceive as primary challenges related to ESG integration in passive investing as an index provider, as well as challenges faced by your clients?

JZ: Before identifying the challenges, I would like to share an observation about passive investing and indexing. Instead of saying active is shifting to passive, they are really converging. The implication is that both passive and active investors face similar challenges on education, institutional adoption, and policy development.

The challenge with education is helping all stakeholders better understand what is and is not ESG investing. For example, establishing a common set of education curriculums taught to business and finance students in the universities will help shape the future of ESG investing, as these students will become investment practitioners and capital allocators.

The institutional adoption challenge is about asset owners making a genuine effort and commitment to integrating ESG considerations in allocating capital. This will have a multiplier effect across the entire capital market ecosystem, from the kinds of companies that IPO to how asset managers value what matters most in companies.

For policy development challenges, we see governments creating incentives and laws that require and encourage companies, exchanges, brokers/dealers, advisors, asset managers, and owners to all adhere to certain minimum ESG standards and compliance.

For these three challenges, I see good progress being made and look forward to contributing in whatever ways we can as an index and financial information provider.

5. RR: What do you see as future opportunities within the ESG index space and what advantages does FactSet bring related to this?

JZ: : Compared to a market-cap-weighted index, which could best be described as in the very late or last inning of development, an ESG index is at the opposite end of the spectrum with plenty of room for innovation and growth. One area of opportunity will come from more targeted and granular segmentation of ESG indices into their respective environmental, social, and governance components. The second area of opportunity will focus on applying an ESG overlay to all index products regardless of their investment objectives. The third will focus on achieving certain ESG outcomes or impact metrics in addition to just financial returns. Ultimately, there will come a time when everyone stops talking about ESG or sustainability indices because they will be innate to the index construction process and unacceptable and unimaginable without it.

All three areas I have outlined require powerful data and analytics, and FactSet has been the platform of choice for third-party ESG information providers to connect with the world’s end users, not to mention our strength in developing our offerings. Finally, due to our diverse client base, we have a front-row seat to see what is working and what is lacking, and this continuous client intelligence enables us to be a very proactive ESG solutions provider.

Conclusion

FactSet Index Solutions uses RepRisk data to create ESG index solutions for FactSet clients and deliver bespoke beta. FactSet values innovation and unconventional approaches to data, and partners with RepRisk because its daily-updated research excludes company disclosures, meaning the data is less biased and timelier – leading to improved securities selection.

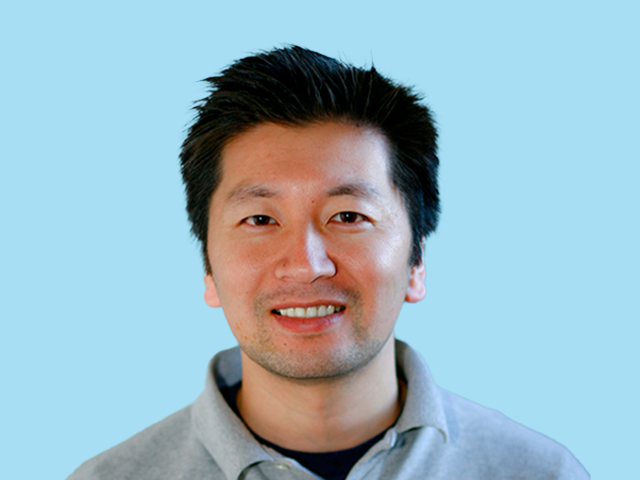

Bio – Jeremy Zhou

Mr. Jeremy Zhou is Vice President, Head of Indexing Solutions at FactSet. In this role, his main responsibilities include alternative data sourcing, index creation and partnership, and investment strategy consulting. Together with top tier index providers and fund sponsors, Mr. Zhou has led the creation of a suite of smart-beta/thematic indices that power exchange-traded funds, unit investment trusts, and passive funds with more than $7 Billion assets under management. Prior to joining FactSet in 2013, Jeremy was a senior executive with Revere Data – a leading alternative data firm acquired by FactSet – and held positions as Head of Index Solutions, Associate Director of Product Strategy, and Director of Healthcare Equity Research. From 2011 to 2013, Jeremy was also a Portfolio Manager for Covestor Ltd. – now part of the Interactive Brokers Group. Mr. Zhou earned a Master of Public Health and a B.S. in Nutrition & Toxicology from the University of California, Berkeley. He is also a CFA charter holder and a member of the CFA Society San Francisco.