# I. What happened?

The US-based Pacific Gas and Electric Company (PG&E) and the Brazilian mining company Vale SA were both linked to catastrophic events at the end of 2018 and the beginning of 2019 that had a substantial impact on the companies’ share prices.

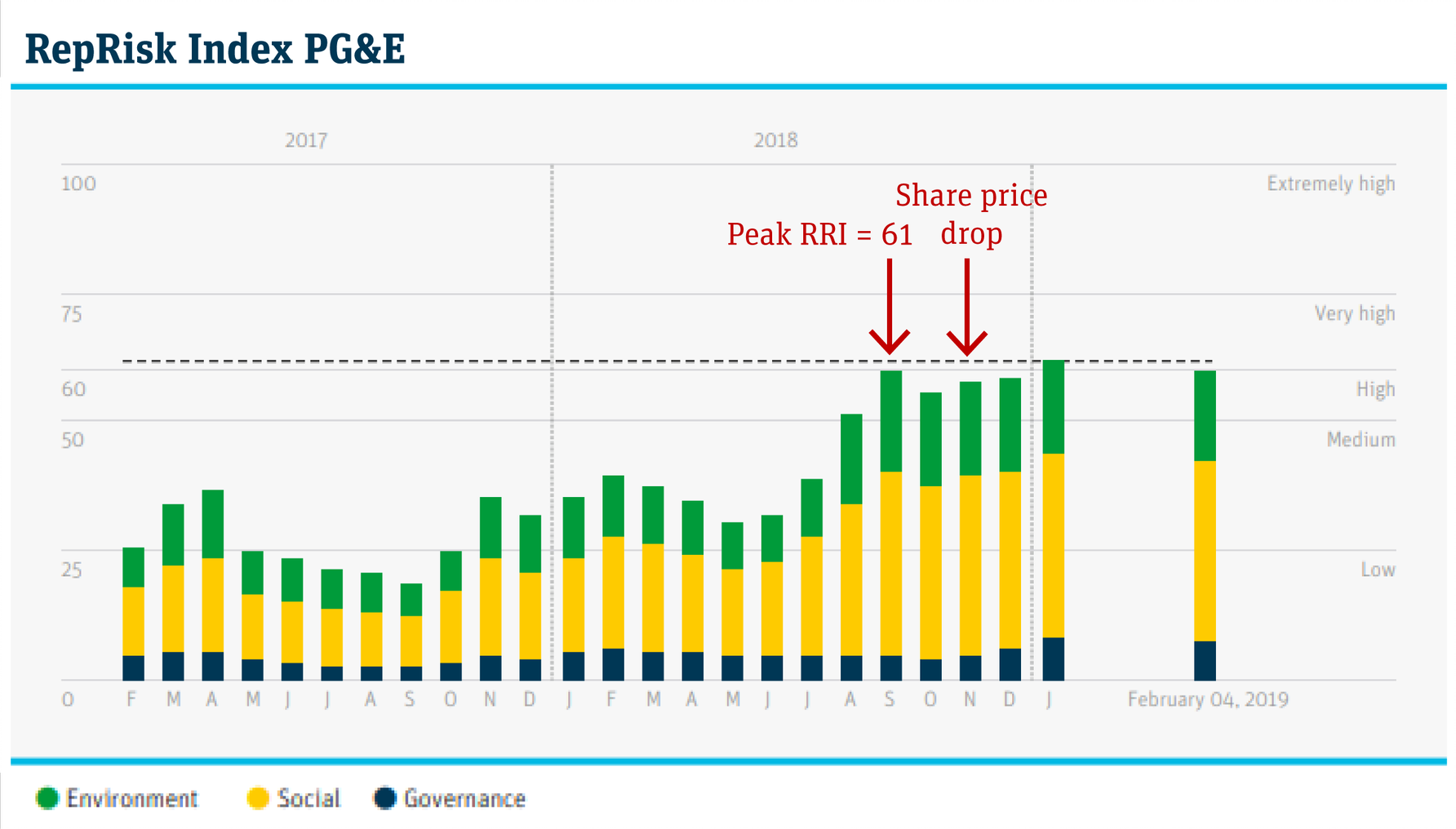

1. PG&E faced allegations in November 2018 that the company’s faulty equipment had caused the Camp Fire in Northern California, which started on November 8, 2018 and swept through the town of Paradise, causing at least 85 civilian deaths, and destroying over 18,000 buildings. By November 15, the company’s share price had fallen by almost 60%.

2. Vale SA was plunged into crisis when the tailings dam of its Corrego do Feijao B1 iron ore mine collapsed near Brumadinho in the Brazilian state of Minas Gerais on January 25, 2019. Vale’s share price dropped 20% on January 28, 2019 in the wake of the disaster.

In both cases, RepRisk’s unique research approach and methodology picked up early warning signals around the high environmental, social, and governance (ESG) risks associated with PG&E and Vale SA. Both companies had very high ESG risk exposure levels (Peak RRI scores) before the above tragedies occurred. These high scores had been triggered by a series of allegations and risk incidents that already raised serious concerns about the business conduct of the two companies.