Nature forward: navigating the Taskforce on Nature-related Financial Disclosures (TNFD)

Climate and nature are intrinsically interconnected, representing two sides of the same coin. They represent a complex interplay where changes in one profoundly affect the other, creating a delicate balance that is essential for life on Earth. Recent years have seen a predominant focus on climate-related risks, driven by international agreements, organizations, extensive research, and the visible impacts of climate change.

In 2019, the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES) released a report highlighting the severe and accelerating decline of biodiversity and ecosystems. It underscored that around 1 million species are at risk of extinction due to human activities. The extensive destruction of the Amazon rainforest, through deforestation facilitated by human activities, such as illegal logging and infrastructure development, have significantly reduced the rainforest’s capacity to absorb Carbon Dioxide (CO2).

The COVID-19 pandemic also highlighted the link between human health and ecosystem health, and the destruction of natural habitats has been linked to the emergence of zoonotic diseases (infectious diseases transmitted from animals to humans). This has reinforced the importance of addressing nature-related risks to prevent future pandemics and protect economic stability. These factors have collectively catalyzed a shift towards recognizing and addressing the critical importance of nature in achieving sustainable development and resilience against environmental risks.

In 2020, the World Economic Forum (WEF) published a report showing that USD 44 trillion of economic value generation – over half the world’s total gross domestic product (GDP) – is moderately or highly dependent on nature and its services. WEF predicts a nature-positive transition could generate up to a little over USD 10 trillion in annual business value and create 395 million jobs by 2030.

In September 2023, the Taskforce on Nature-related Financial Disclosures (TNFD) published its much-anticipated final recommendations. The TNFD marks an important step to tackle the risk of nature loss to the global economy and reduce businesses’ impact on nature. The TNFD aims to create resilience in the global economy by redirecting flows of finance, at scale, toward nature-positive activities that align with the Paris Agreement, the targets and goals of the Kunming-Montreal Global Biodiversity Framework (GBF), the Convention on Biological Diversity’s Post-2020 Global Biodiversity Targets, and the UN Sustainable Development Goals (SDGs).

# I. Recommendations of the TNFD

The TNFD recommendations adopt the similar four pillars to the framework of the Task Force on Climate-related Financial Disclosures (TCFD): 1) governance, 2) strategy, 3) risk and impact management, and 4) metrics and targets.

The recommendations are based on four foundational principles:

- The breadth and depth of disclosure ambition is increased over time, consistent with both the International Sustainability Standards Board (ISSB) standards and its global sustainability reporting baseline, and the global policy goals and targets in the GBF.

- Materiality is the basis for disclosure; organizations should disclose material information about their nature-related dependencies, impacts, risks, and opportunities.

- Jurisdictions have different approaches to materiality, and these differences can be accommodated in TNFD-aligned reporting.

- The identification and assessment of nature-related issues should be comprehensive. Understanding an organization’s dependencies and impacts on nature will inform a robust understanding of its potentially material risks and opportunities.

In summary, the recommendations are:

# 1. Governance:

- Disclose the organization's governance processes for assessing and managing nature-related risks and opportunities.

- Identify the board's oversight role and management's responsibility for nature-related issues.

# 2. Strategy:

- Describe the actual and potential impacts of nature-related risks and opportunities on the organization's business, strategy, and financial performance.

- Disclose how the organization's strategy considers nature-related risks and opportunities over the short, medium, and long term.

# 3. Risk management:

- Disclose the processes for identifying, assessing, and managing nature-related risks.

- Describe how these processes are integrated into the overall risk management framework.

# 4. Metrics and targets:

- Disclose the metrics used to assess and manage nature-related risks and opportunities.

- Describe the targets used to manage nature-related risks and opportunities, and report on performance against these targets.

The TNFD recommendations can be applied by a wide range of market participants including companies, investors, financial institutions, regulators, stock exchanges, assurance and accounting firms, data providers, credit rating agencies, and financial service providers.

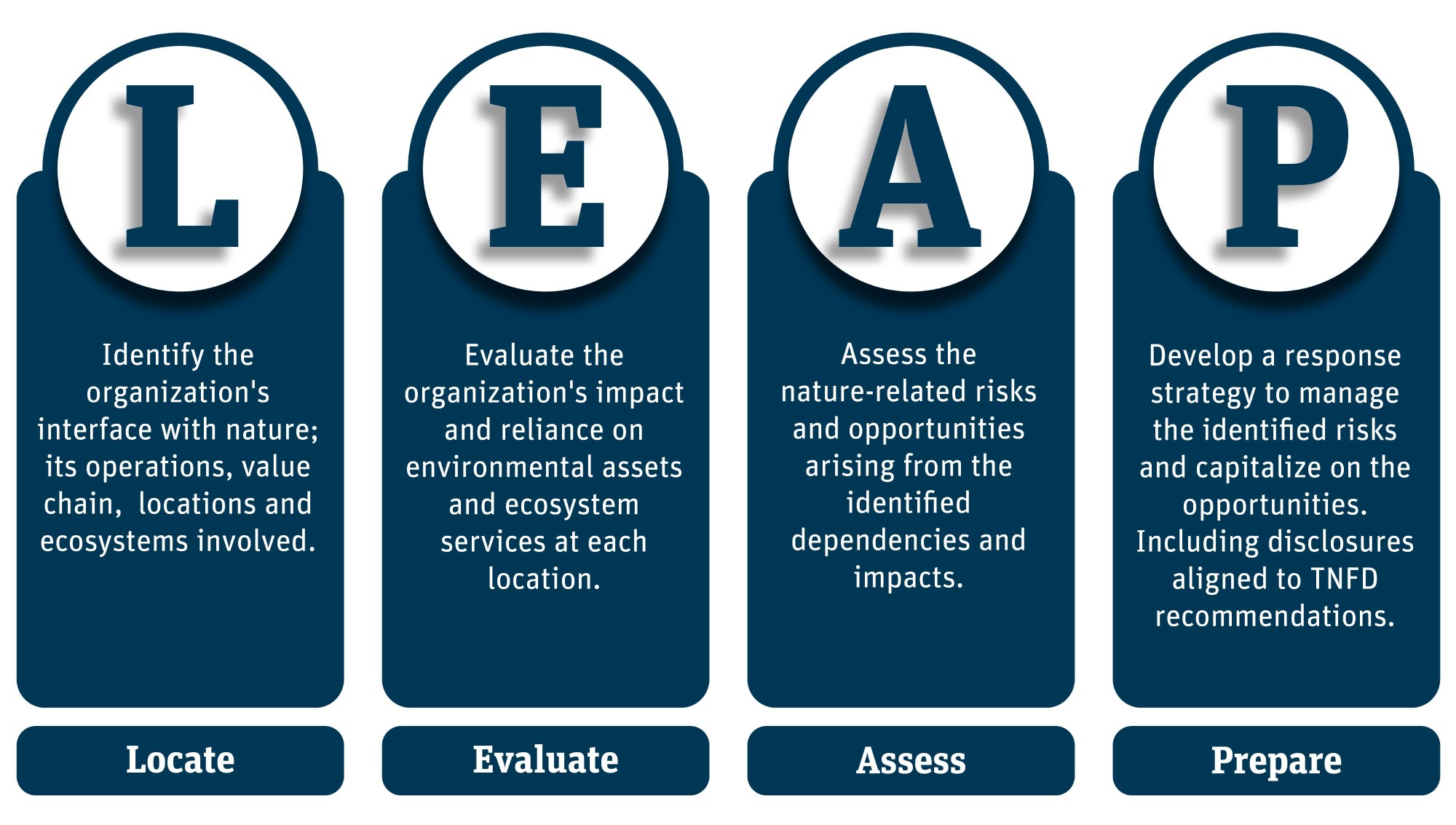

To encourage organizations to voluntarily adopt its recommended disclosures, the TNFD developed the LEAP approach, a guide on identifying, assessing, and reporting nature-related issues. It consists of four phases:

- Locate: identify the organization's interface with nature, including its direct operations and value chain activities, and the specific locations and ecosystems involved.

- Evaluate: evaluate the organization's dependencies and impacts on nature at each identified location. This involves analyzing the environmental assets and ecosystem services the organization relies on and the potential negative or positive effects it has on them.

- Assess: assess the nature-related risks and opportunities arising from the identified dependencies and impacts. This includes analyzing the potential financial, operational, and reputational risks, as well as opportunities for sustainable growth and innovation.

- Prepare: develop a response strategy to manage the identified risks and capitalize on the opportunities. This involves setting targets, defining key performance indicators, and implementing actions to mitigate risks and enhance positive impacts. It also includes preparing disclosures aligned with the TNFD recommendations.

# II. The TNFD use case in the financial industry

- Risk management: TNFD helps financial institutions identify and manage their exposure to nature-related risks, such as the physical risks of climate change and biodiversity loss, as well as the transition risks associated with shifting to a low-carbon and nature-positive economy. This enables them to make more informed investment and lending decisions.

- Portfolio alignment: TNFD encourages financial institutions to align their portfolios with global biodiversity goals and net-zero targets. This could involve investing in nature-based solutions, divesting from harmful activities, and engaging with companies to improve their environmental performance.

- Disclosure and transparency: TNFD promotes transparency in reporting nature-related risks and opportunities. This helps investors and stakeholders assess the financial institution's environmental impact and resilience.

Next steps and the way forward

The TNFD now focuses on encouraging widespread adoption and implementation of its recommendations. This includes developing sector-specific guidance, refining metrics, and building capacity among organizations to effectively assess and disclose their nature-related risks and opportunities. The TNFD will also continue to collaborate with governments, regulators, and other stakeholders to ensure the framework aligns with evolving global policy goals and targets.

The impact of TNFD on the ESG industry is already significant, as it provides a comprehensive framework for companies to assess and report on their nature-related risks and opportunities, enhancing transparency and accountability. This is expected to drive a shift in investment and lending practices towards more sustainable and nature-positive activities, ultimately transforming the financial landscape and contributing to a more resilient and equitable future.

Want to learn more about RepRisk solutions for TNFD?

Contact your Account Manager or our Client Services Team (support@reprisk.com)

Copyright 2024 RepRisk AG. All rights reserved. RepRisk AG owns all intellectual property rights to this report. This information herein is given in summary form and RepRisk AG and/or the third party contributors to this report make no representation or warranty that any data or information supplied to or by it or them is complete or free from errors, omissions, or defects. Without limiting the foregoing, in no event shall RepRisk AG and/or the third party contributors to this report have any liability (whether in negligence or otherwise) to any person in connection with the information contained herein. Any reference to or distribution of this report must include a link to the content to provide sufficient context. The information provided in this presentation does not constitute an offer or quote for our services or a recommendation regarding any investment or other business decision, and is not intended to constitute or to be used as a substitute for legal, tax, accounting, or other professional advice. Please note that the information may have become outdated since its publication. Should you wish to obtain a quote for our services, please contact us.