# I. Introduction

Supply chains are an essential part of the business process, and they impact business continuity and profitability. Yet, as supply chains frequently cross borders and responsibility becomes fuzzy as degrees of separation from suppliers increase, they are prone to risks, especially ESG and business conduct risks – which can translate into bottom-line financial, reputational, and compliance impacts for companies involved.

To mitigate and prevent adverse impacts, companies rely on data for decision-making in their risk assessment and screening processes related to suppliers and supplier facilities. For suppliers in emerging and frontier markets, ESG data is difficult to gather and access, or, if available, it’s mostly self-reported – and therefore unreliable, especially when it comes to risks – outdated, and incomplete. Despite this data gap, companies are expected to comply with emerging regulations and standards such as the Modern Slavery Act 2015.

In this challenging environment with increased regulatory scrutiny, the COVID-19 pandemic posed a unique and unexpected condition, altering both supply and demand patterns at the same time, while amplifying existing ESG risks. For many companies, the pandemic and subsequent disruptions led to consideration of supply chain diversification or even bringing operations closer to home in a trend called re-shoring. This report investigates how the nature of supply chain related ESG risk incidents has transformed during the COVID-19 pandemic and outlines how companies can navigate the changing landscape.

# II. How the pandemic disrupts the ESG risk landscape of supply chains

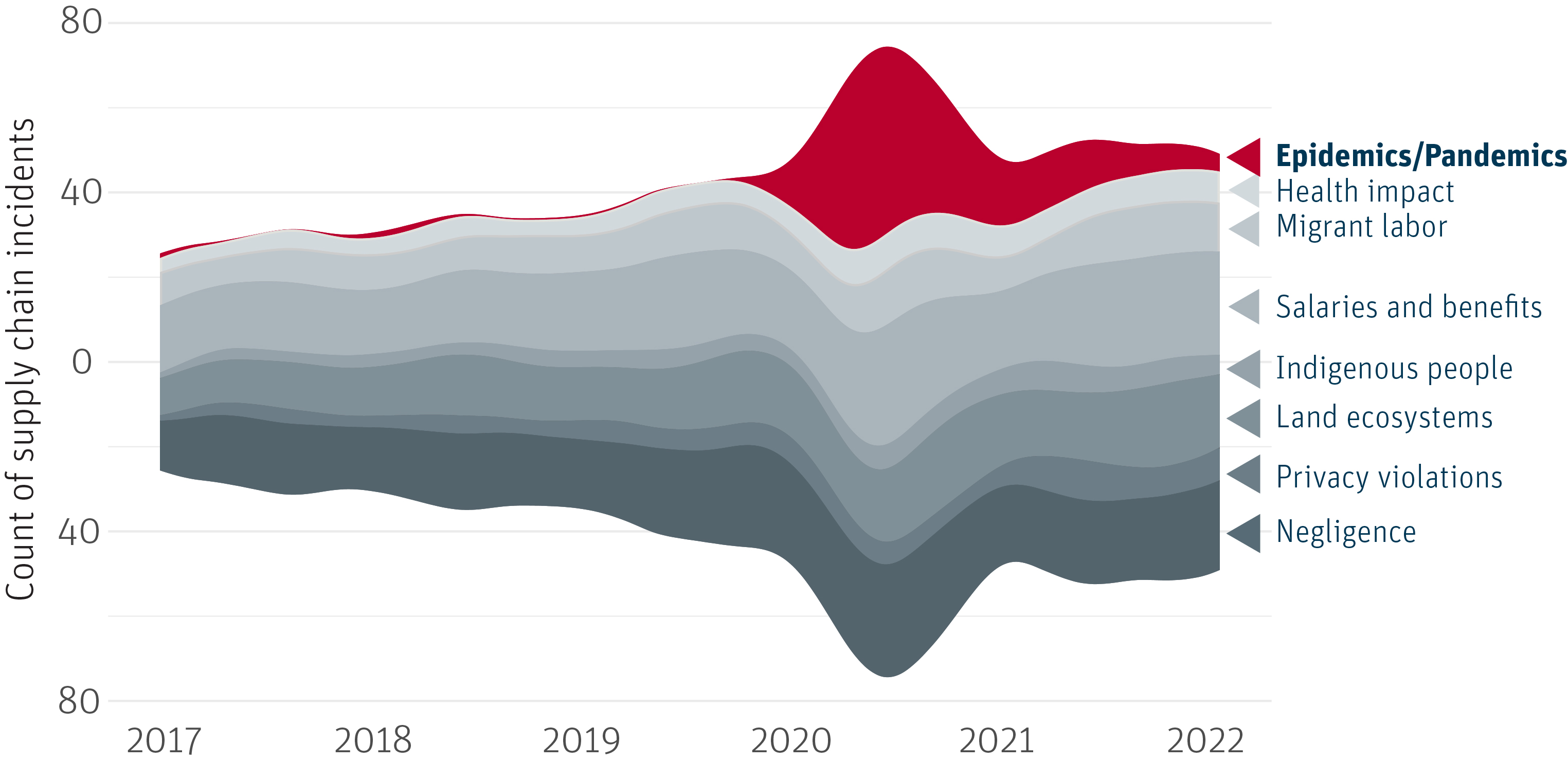

Over the past two years, eleven percent of companies (approximately 7,500) in the RepRisk dataset with incidents during this period were linked to a supply chain risk incident. In the Retail and Personal and Household Goods sectors, this percentage increased to 25% (approximately 2,200 companies of 9,000) and 28% (approximately 1,900 companies of 6,900), respectively. Reviewing the past five years of supply chain incident data, we observed a noticeable disruption in 2020 and 2021 to the traditional distribution of key topics for supply chains.

# III. Disruption of top ESG issues linked to supply chains

Source: RepRisk ESG data science and quantitative solutions, www.reprisk.com

Criticism and risk incidents referring to companies’ actions and liability in spreading the pandemic (“Epidemics/Pandemics” in the above graphic) combined with supply chain issues spiked during the height of the COVID-19 pandemic. These incidents displayed a broad risk profile across the spectrum of ESG:

Unsafe working conditions contributing to the spread of COVID-19

Cases of withholding wages, union-busting, and illegal termination as revenue decreased during the pandemic

Price-gouging amid increasing demand for certain products during the pandemic

Medical waste pollution impacting local ecosystems and communities

Product concerns in the pharmaceutical industry surrounding the development of vaccines

Digging deeper into three prominent topics discussed above, migrant labor, negligence, and salaries and benefits, the chart below details the evolution of these topics over the past five years, split by whether incidents were also linked to the pandemic.

# IV. Evolution of supply chain topics and their overlap with the pandemic

Source: RepRisk ESG data science and quantitative solutions, www.reprisk.com

In particular, supply chain incidents linked to salaries and benefits saw significant connection to the pandemic during its peak. Although case counts remained high, the number of times companies’ actions had adverse impacts related to the spread of the pandemic linked to supply chain incidents significantly levelled off in 2021 and early 2022. As the COVID-19 disruption settles, we see the distribution of supply chain related topics returning to pre-pandemic patterns.

# V. How existing ESG risks were amplified by the pandemic

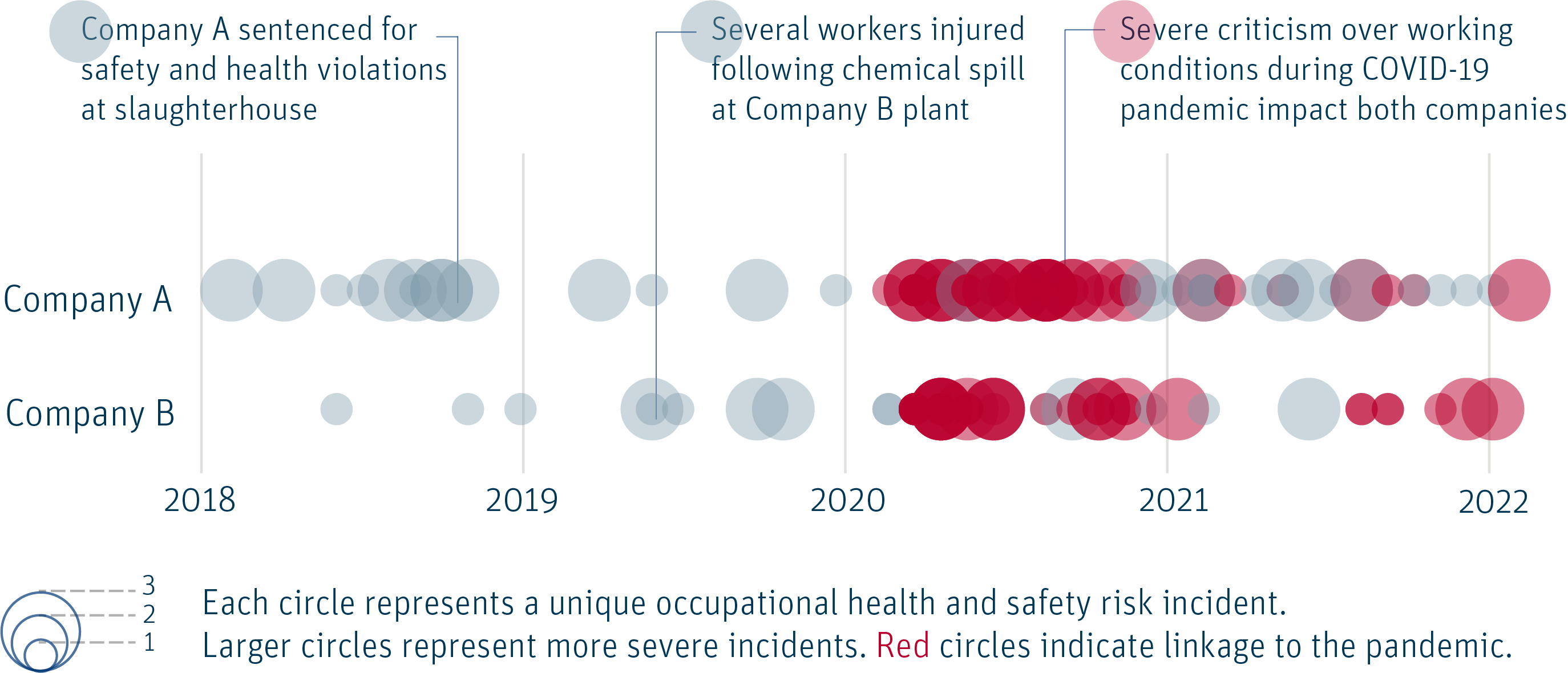

Early in the pandemic, the meat processing industry was criticized for working conditions that endangered employees. Were there indicators of risk before the pandemic began?

We looked at two of the largest global meat suppliers and their risk incidents leading up to and during the pandemic.

# VI. Indicators of risk: COVID-19 and the meat processing industry

In the years leading up to the COVID-19 pandemic, RepRisk picked up on occupational health and safety risk exposure linked to meat processing companies.

Source: RepRisk ESG data science and quantitative solutions, www.reprisk.com

Our data shows that both companies saw several occupational health and safety risk incidents in the years leading up to 2020, with a handful of these being severe. When the pandemic struck, these vulnerabilities were accentuated. For Company A, a higher risk incident count before the pandemic translated into a period of consistent severe risk incidents throughout 2020.

# VII. All eyes on the pandemic — what else was happening?

Impacts of the pandemic were first seen in connection with intrinsically associated issues, such as occupational health and safety. As the pandemic demanded collective attention on one issue, this focus may have given way to a faltering in the prevention and mitigation of other issues – for this reason, we looked more closely at the development of four key ESG issues over the past five years: anti-competitive practices, local participation issues, misleading communication, and overuse and wasting of resources.

# VIII. Evolution of four key ESG issues during the pandemic

Source: RepRisk ESG data science and quantitative solutions, www.reprisk.com

Anti-competitive practices: Most companies were unprepared for a crisis on the scale of COVID-19 and faced financial problems. The resulting mergers and acquisitions during this time raised questions about anti-competitive practices. Our data confirms this development and over the course of 2020, we observed a jump in the number of monthly anti-competitive practices incidents, most commonly in the Construction and Materials and Retail sectors.

Local participation issues: Local participation issues refer to when actions of a company negatively impact a community and the community or individuals are not properly consulted. The three sectors with the most incidents linked to this issue in the period from 2020 to 2022 were Mining, Utilities, and Oil and Gas, where consultation procedures with local communities may have been impacted by the pandemic.

Misleading communication: This issue refers to framing of a company’s actions that aims to deceive or oversell, including instances of greenwashing, and is often found linked to other ESG issues. In the period from 2020 to 2022, the three most linked issues were adverse impacts on landscapes, ecosystems, and biodiversity; climate change, greenhouse gas (GHG) emissions, global pollution; and health impact. Notably, risk incidents related to companies’ actions and liability in spreading the pandemic were the fifth most linked issue.

Overuse and wasting of resources: From hoarding home goods to a necessary increased reliance on single-use plastics, many efforts to curb excessive consumption and plastic waste went by the wayside during the height of the pandemic. We found the increase in overuse and wasting of resources extended to companies’ practices, with the average monthly number of these incidents doubling during this period.

Although diverse in their impacts, each of these four issues is important to consider in the context of supply chains. In the section that follows, we introduce how RepRisk can help manage ESG risk exposure.

# IX. How ESG risk management strengthens operational resilience across supply chains

While unprecedented events like the COVID-19 pandemic are difficult to prepare for, a robust ESG due diligence and risk management process can make companies more resilient and future-proof when they do occur – this is an often-overlooked value proposition of ESG risk integration into supply chain management. Such practices can reduce vulnerability to disruption, help companies to bounce back faster – effectively maintaining profitability and sustainability.

RepRisk is uniquely poised to help companies integrate ESG and business conduct risk assessments into supply chain processes:

We offer private company and infrastructure project (e.g., supplier facility) coverage, helping companies with ESG screening upon onboarding new suppliers or evaluating current ones.

Additionally, to help navigate inherent ESG risks in the location and industry of suppliers, we offer country-sector metrics and analytics.

Our research process covers sources in 23 languages, ensuring we capture risks early, at the local level – across developed but also emerging and frontier markets.

We offer in-depth research and incident details, supporting engagement and audit procedures.

We inform supplier compliance checks with internal policies, Supplier Codes of Conduct, and international standards such as the UNGC, the UNGPs, SASB, and SDGs.

Our research approach takes an outside-in perspective, meaning we can help assess the impact a company has on people and planet. We intentionally exclude company disclosures and self-reporting from our analysis. This unique perspective serves as a reality check for how companies conduct their business – do they walk their talk when it comes to human rights, labor standards, corruption, and environmental issues?

Conclusion

In-depth knowledge of ESG issues in supply chain operations offers the benefit of risk mitigation as well as the opportunity to proactively foster better practices. The COVID-19 pandemic highlighted the role of ESG in organizational and supply chain resilience. At the same time, it showed us that a myopic approach to ESG can lead to unintended consequences, and the pillars of E, S, and G are most effective when considered holistically.

# X. Appendix: Overview of current regulations

With growing regulatory scrutiny and rising public awareness about the hidden risks in supply chain operations, companies are increasingly expected to disclose ESG information regarding their supply chains. A growing number of legislative acts have imposed significant obligations on companies that source their products and services through supply chains from developing and emerging countries.

Table 1: an overview of a few key supply chain acts passed in the past decade.

The first step to managing ESG risks in supply chains is identifying them, a task which requires granular, consistent, material, and timely data. RepRisk offers Framework Templates for three of the above supply chain acts to facilitate monitoring and compliance. The list of regulations is constantly evolving, with new proposals and acts such as the EU Proposal for a Directive on Corporate Sustainability Due Diligence, changing the landscape.

Copyright 2022 RepRisk AG. All rights reserved. RepRisk AG owns all intellectual property rights to this report. This information herein is given in summary form and does not purport to be complete. Any reference to or distribution of this report must include a link to the content to provide sufficient context. The information provided in this presentation does not constitute an offer or quote for our services or a recommendation regarding any investment or other business decision. Should you wish to obtain a quote for our services, please contact us.